Blog: What the UK's Carbon Border Adjustment Mechanism (CBAM) means for industry

The UK Government is gearing up to introduce a Carbon Border Adjustment Mechanism (CBAM) in 2027 to reduce the risk of "carbon leakage", where production and associated emissions are effectively shifted overseas.

UK plans trail 12 months behind the European Union’s timetable for similar measures.

In December 2023, HM Treasury and the Department for Energy Security and Net Zero (DESNZ) announced that goods from certain sectors imported into the UK from any country with a lower or no carbon price will soon have to pay a levy.

Read the Government’s position paper on GOV.UK [PDF] for full details.

The Chancellor Jeremy Hunt's aim is to ensure that products made overseas face a comparable “carbon price” – that’s the cost applied to carbon pollution to encourage polluters to reduce the amount of greenhouse gases they emit – to UK-produced goods.

Products can be raw materials, energy (such as electricity or heat), component parts, or finished goods.

The UK Government’s intention here is that domestically manufactured, high-energy products cannot be undercut by other parts of the world where energy costs are materially lower; and possibly more carbon-intensive.

In essence, a CBAM scheme is a tax which will ensure that highly traded, carbon-intensive products from overseas in the iron, steel, aluminium, fertiliser, hydrogen, ceramics, glass and cement sectors face a comparable carbon price to those produced in the UK.

Details of the proposed UK scheme were released for public consultation on 21 March, with the Government setting out how it intends to structure and administer a CBAM. Businesses now have until 13 June 2024 to submit their views.

AIC is currently modelling scenarios with economists to understand the potential impact a CBAM on fertilisers might have on UK agriculture.

Here's four things that we know so far:

1. Fertiliser is within scope

Included in the scope of the proposed UK-CBAM are:

- Mineral or chemical nitrogen fertilisers

- Ammonia in granular and liquid forms

- Nitric acid and sulphonitric acids

- Nitrates of potassium

- Mineral or chemical fertilisers containing two or three of the fertilising elements nitrogen, phosphorus and potassium

- Note: "P&K fertilisers" which contain just phosphorus and potassium are an exception

Hydrogen is also within the scope of UK-CBAM generally.

2. UK proposals are less complex than the EU’s approach

Somewhat surprisingly, the UK Carbon Border Adjustment Mechanism (UK-CBAM) is not modelled on the existing EU scheme of the same name although it does follow similar basic principles.

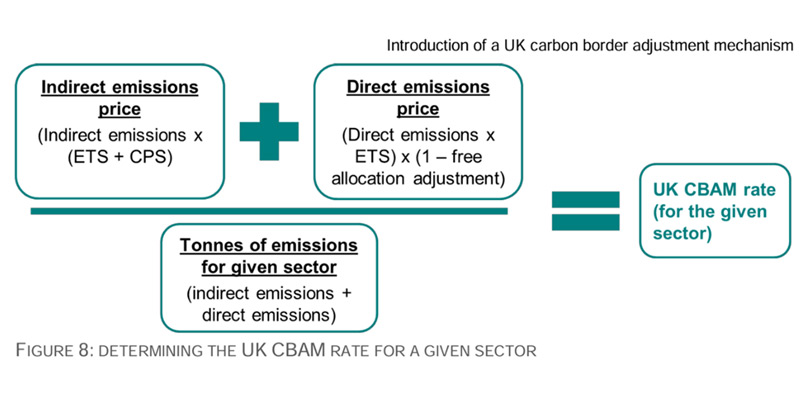

The UK-CBAM rate should be comparable to the carbon price faced in the UK by domestic producers, after accounting for adjustments, exemptions or compensation schemes.

Based on the announced government policy, the pricing mechanisms currently expected to be in place for 2027 are:

-

free allocation of allowances under the UK ETS, and;

- the carbon price support (CPS) rate on electricity generated using fossil fuels in Great Britain

The UK still manufactures ammonia, ammonium nitrate and nitric acid – all of which are in the scope of a UK-CBAM.

3. Goods valued above a certain threshold will be charged

Charges will apply to goods in scope that are valued above a £10,000 minimum threshold from 2027.

For example, initial basic modelling suggests that costs for non-compliant urea from a country without any ETS or carbon pricing may be in the region of £33/tonne or more.

This differs from the EU's CBAM where charges have a tapered introduction payable at a rate of one-tenth of the eventual full tariff, ratcheting up by 10% each year between 2027 and 2036.

4. CBAM may challenge international trade rules

World Trade Organisation (WTO) rules don’t allow discrimination of “like” products, so there are significant concerns that these international trading agreements may be broken by a CBAM.

Policymakers see a CBAM as an additional tool that seeks to complement the EU’s Emissions Trading Scheme (ETS) – a cap-and-trade system which caps the total level of greenhouse gas emissions, creating a carbon market with a carbon price signal to incentivise decarbonisation.

This scheme already distinguishes between industries within the EU, so it may be argued not to be a protectionist measure that could make a distinction between EU “products” and imported products.

This suggests that UK businesses will be obliged to play by the same rules as the EU to ensure herd immunity from the WTO.

If fertilisers are made with non-carbon or less carbon-intensive precursors, such as carbon capture and storage (CCS) or Green Hydrogen Ammonia, this may also be in the scope of CBAM. To do otherwise may contravene WTO rules.

Naturally, all this will be subject to lengthy consultation and many third countries such as China have already expressed their dissatisfaction with the EU's CBAM.

All of this is a recipe for legal challenges appearing before the WTO in the not-to-distant future. If recent history is anything to go by, such cases are not resolved quickly.